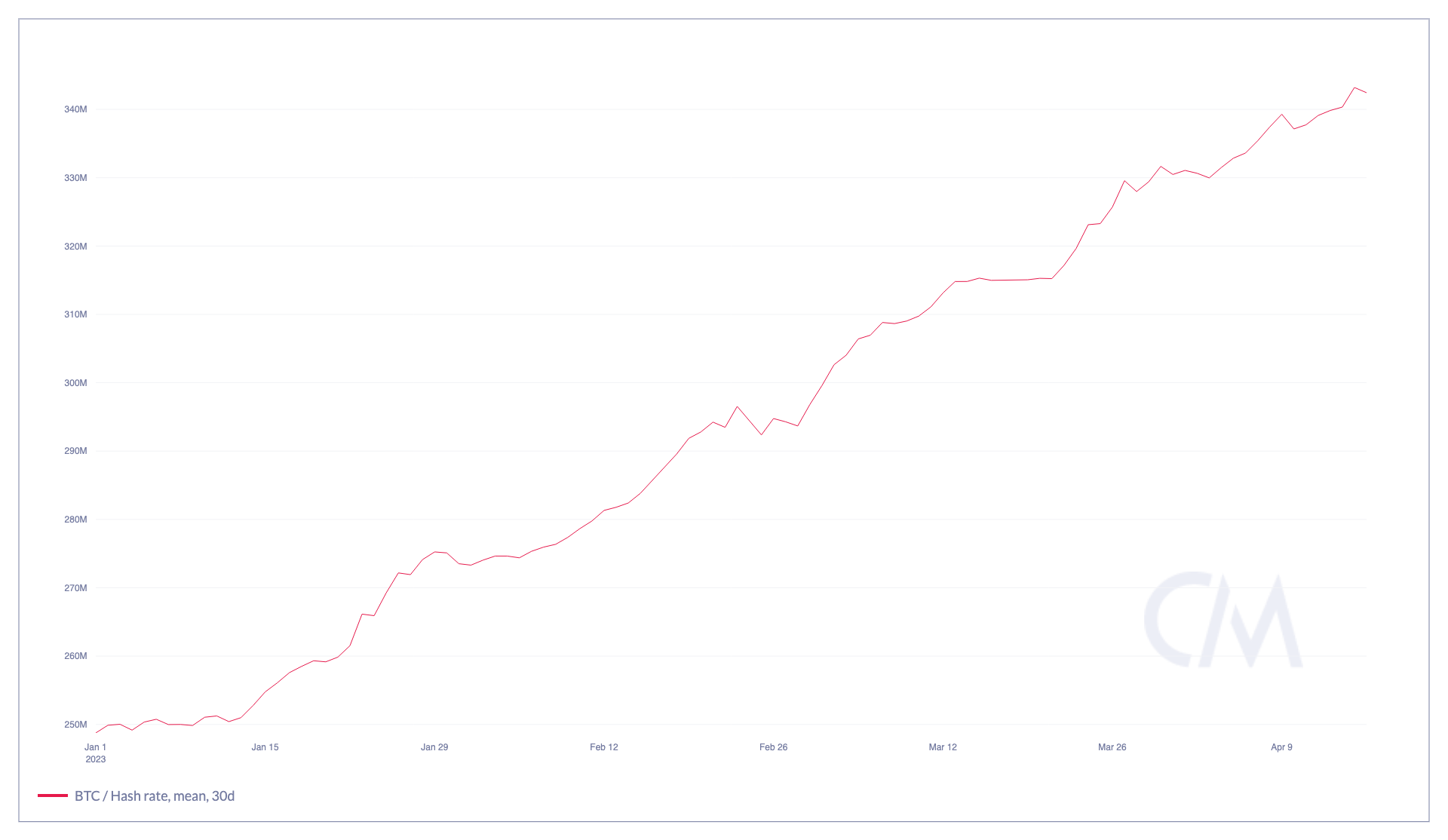

Bitcoin continues its mini-bull run, rising to $28,478 per coin as of March’s end – an increase of 23% on the closing price for the previous month and 72% for the first quarter of 2023. The increase actually outpaced the growth of difficulty by nearly 33%, resulting in industry mining revenues higher by over 30% per TH in the quarter.

Still, if you consider the growth in global hashrate over the last 12 months, it’s more than doubled over the period as has difficulty.

Many analysts (including the author) were forecasting a 2023 end-of-year hashrate of 350 EH/s. But that number has already been surpassed in the first quarter, and with the Bitcoin price continuing its current trajectory, providing more profitability in mining, the potential global hashrate in the next 8-9 months could close significantly above 400 EH/s.

Argo Blockchain (ARB.L, ARBK)

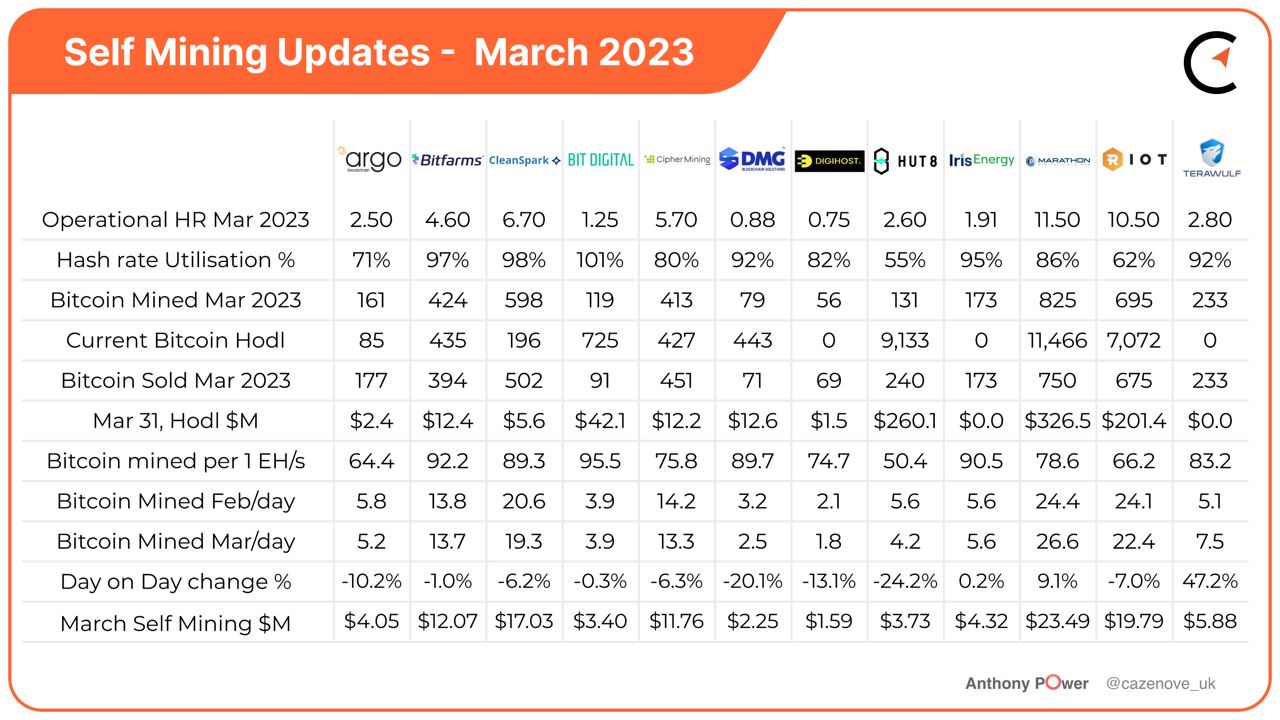

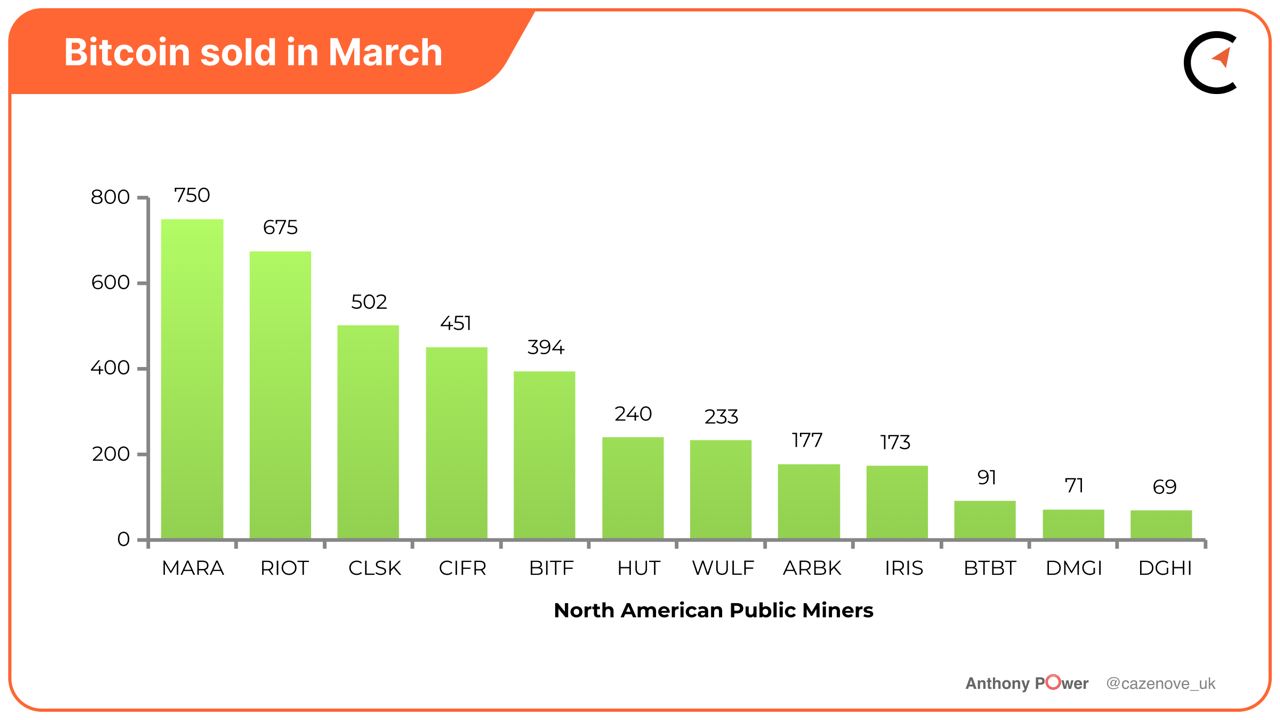

The March mining update for Argo Blockchain was to be expected, as the company has not been able to increase its current operational hashrate since August 2022, remaining at 2.5 EH/s. During the month, the company mined 161 Bitcoin, achieving $4.05 million in revenues, at a rate of 5.2 Bitcoin per day, a 10.2% decrease on the previous month. The company sold 177 Bitcoin in March to cover operational costs and has a current hodl of 85 Bitcoin, valued at $2.4 million.

On a more positive note, the company announced the appointment of Jim MacCallum as chief financial officer, who can hopefully bring some much needed finance and accounting knowledge to Argo Blockchain.

Bitfarms (BITF)

Consistency is probably the adjective most associated with the monthly mining updates from Bitfarms. The company currently has 10 sites spread across four countries, and yet it’s always the first North American listed miner to publish its monthly updates. March was no different.

The company produced 424 Bitcoin in March, equivalent to $12.1 million in revenue, at a rate of 13.8 Bitcoin per day, a decrease of 1% on the previous month.

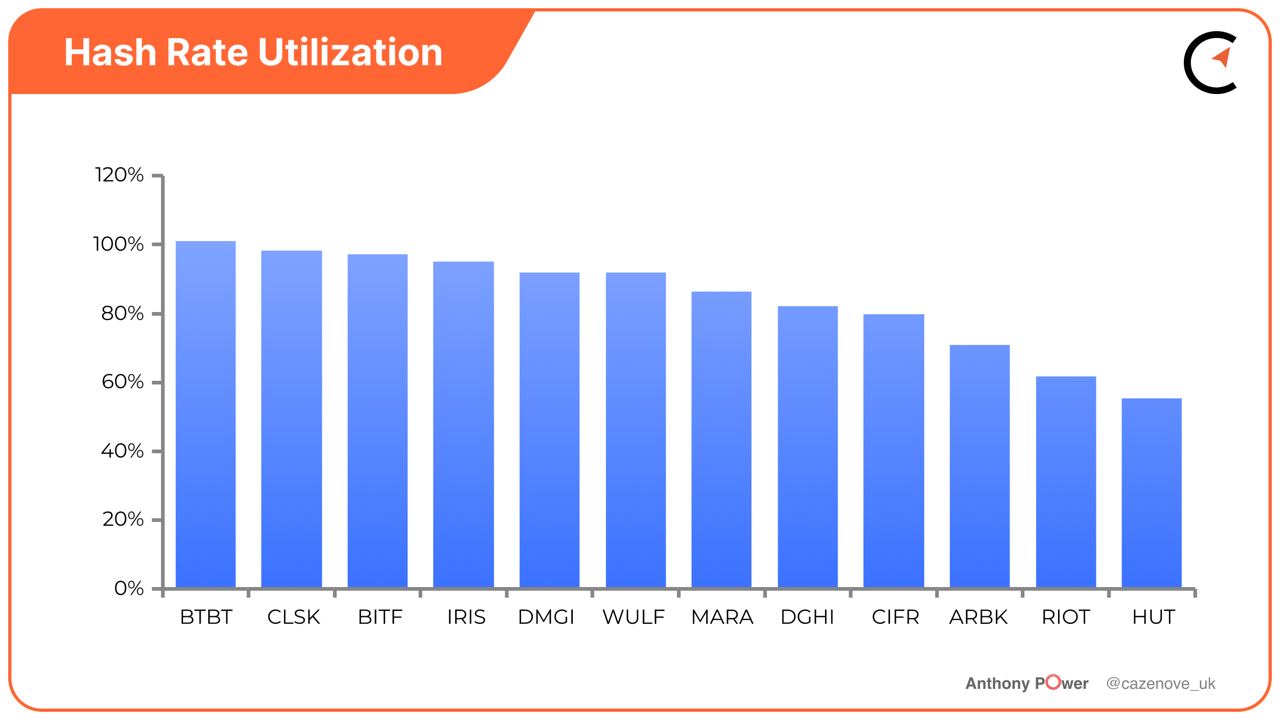

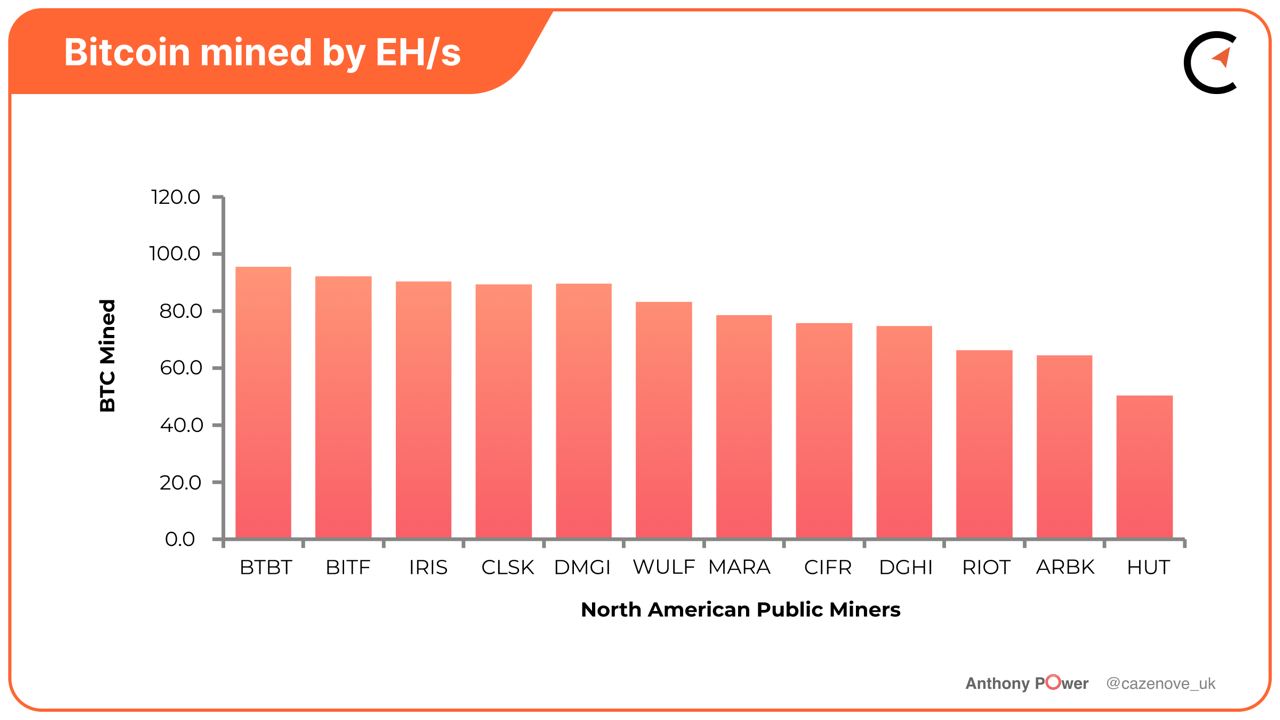

The operational hashrate increased during the month by 0.3 EH/s to 4.6 EH/s, helped by the warmer weather, therefore reducing the load provided back to the local power grids. Biftarms’ production equivalent of 92.2 Bitcoin per EH/s was exceeded by only one other miner, similarly to its hashrate utilization of 97%, only bettered by Bit Digital and CleanSpark.

The company sold 394 of its monthly production to meet capital and operational costs, providing an additional 30 Bitcoin back to treasury, which increased its hodl to 435 Bitcoin.

The last ten months have seen a remarkable turnaround for Bitfarms in terms of balance sheet management. The company reduced its debt on the balance sheet by a further $2 million to $21 million, held $29 million in cash and cash equivalents and a further $22 million in future miner purchase agreements in addition to the Bitcoin hodl valued at $12.4 million as of March 31, 2023.

On April 11, 2023, Bitfarms announced that it had entered into agreements to acquire 22 megawatts (MW) of hydro power capacity and to lease a site in Baie-Comeau, Quebec. To keep costs down the company will use infrastructure equipment from its recent sale of the de la Pointe facility and use a portion of the hardware credits for miner procurement. Bitfarms plans to have 11 MW online by the third quarter of 2023, with the remaining 11 MW during the second half of 2024.

CleanSpark (CLSK)

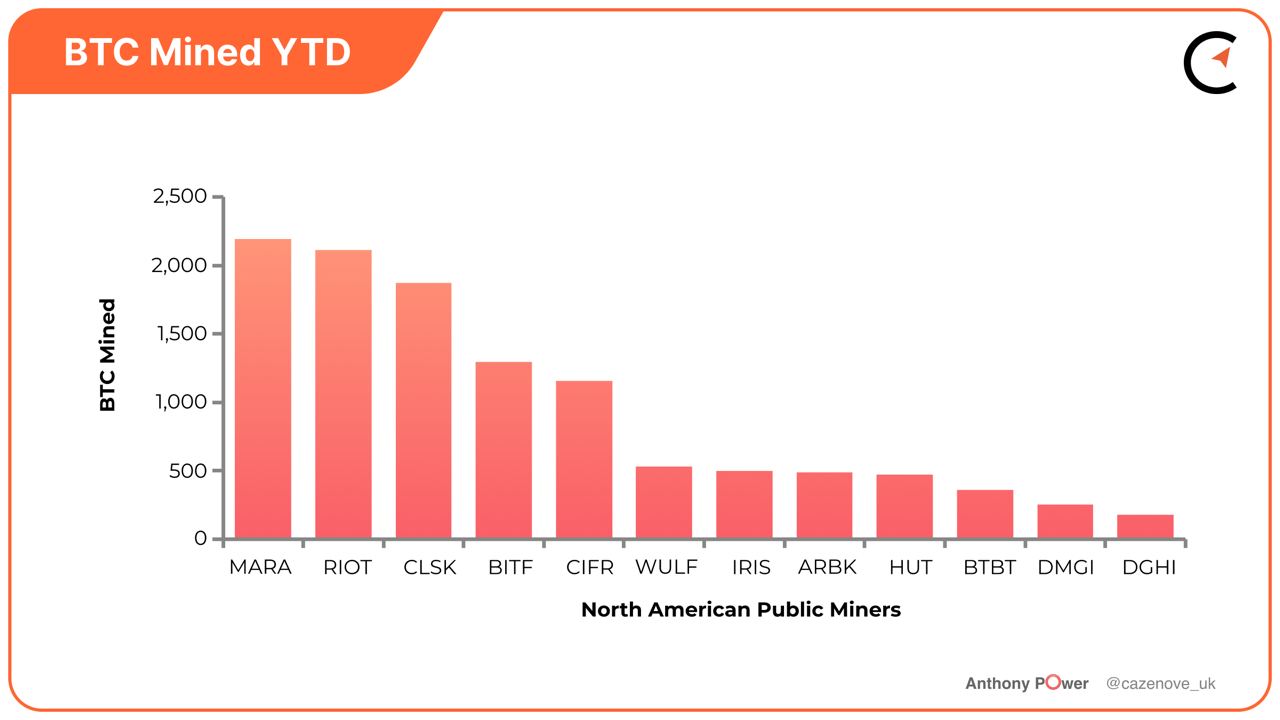

CleanSpark had another great month, producing 598 Bitcoin at a rate of 19.3 Bitcoin per day, achieving $17.03 million in revenue and taking its total production for Q1 to an impressive 1,871 Bitcoin.

The company has over 67,700 latest-generation Bitcoin miners currently providing a hashrate of 6.7 EH/s. The company was able to effectively mine 89.3 Bitcoin per EH/s while achieving an exceptional utilization rate of 98%, only bettered by Bit Digital during the month. CleanSpark sold 502 Bitcoin during the month to cover capital and operational costs and has a current hodl of 196 Bitcoin with a value of $5.6 million.

The Washington expansion, providing 50 MW, is on schedule and with new S19j Pro+ miners starting to arrive this month. Once fully installed, they will increase the company’s hashrate to 8.7 EH/s.

On April 11, 2023, CleanSpark announced it had purchased an additional 45,000 S19 XP Bitcoin mining machines for a total of $144.9 million, representing $23 per TH/s. All the machines are expected to be delivered in batches starting in August, with the last batch of 20,000 machines will be ready for delivery in September, providing an additional 6.7 EH/s and taking the total operational hashrate to 15.9 EH/s.

Having been the only North American listed miner to successfully achieve more than its 2022 growth target, this latest purchase, once installed, will leave the company a mere 100 PH/s away from its current end-of-year growth target of 16.0 EH/s.

Iris Energy (IREN)

Iris Energy had a strong monthly performance – producing 173 Bitcoin at an average of 5.6 Bitcoin per day, an increase of 0.2% when compared to February daily production. Considering the impact of the Bitcoin mining difficulty, this was achieved by an increase in the average operational hashrate from 1.73 EH/s to 1.91 EH/s. The company also reported that it had achieved 3.1 EH/s as of April 5, 2023.

Iris Energy issued a further update, advising that the operational hashrate had subsequently been increased to 3.6 EH/s with a further 1.9 EH/s of miners delivered, pending installation. This will take the company’s total operational hashrate to achieve the company’s target of 5.5 EH/s. In terms of power, 160 MW supporting 4.9 EH/s is available immediately, with commissioning of the first 20 MW at Childress for the remaining 0.6 EH/s expected in the coming weeks.

The Company also announced that between March 13 and April 11, 2023, an entity affiliated with Mr. Michael Alfred, who sits on the company’s board of directors, acquired a total of 430,461 ordinary shares in aggregate for total consideration of approximately $1,283,253.

Marathon Digital (MARA)

Marathon Digital had a record month in March, producing 825 Bitcoin at a rate of 26.6 Bitcoin per day, an increase of 9.1% on the previous month, taking its quarterly production to 2,195 Bitcoin, second only to Core Scientific (CORZQ).

This was helped by a further 2.0 EH/s being added in March, with 9,400 S19 XPs energized in Ellendale, North Dakota, and approximately 3,500 S19 XPs energized in Jamestown, North Dakota, and taking its current total operational hashrate to 11.5 EH/s. The growth in hashrate over the first quarter of 2023, from 7.0 EH/s to 11.5 EH/s, is a staggering 64%, but will need to be significantly increased if the company is going to meet its target hashrate of 23.3 EH/s by the middle of 2023.

Marathon Digital has arguably the most efficient fleet of Bitcoin miner machines when compared to all the North American listed miners, with a majority of the latest S19j Pro and S19 XP machines making up its current fleet. The company’s most recent 10-K highlights that it will soon have a total of 106,400 S19 XPs operating at its Garden City and Granbury sites in Texas and its Ellendale and Jamestown sites in North Dakota.

The company is currently installing immersion cooling technology at a number of sites, which should further increase the efficiency of Bitcoin mining operations by reducing the amount of energy required to cool the mining equipment and help improve the performance of the equipment, enabling machines to achieve higher hashrates and potentially increase mining rewards.

The company sold 750 Bitcoin during the month to cover operational costs and will continue to sell a portion of its monthly production to cover ongoing capital and operational costs. Marathon Digital still holds 11,466 Bitcoin in its treasury, with a value of $326.5 million with a further $124.9 million in unrestricted cash and cash equivalents on its balance sheet.

TeraWulf (WULF)

TeraWulf is the latest publicly traded miner to be included in the monthly analysis and has had an impressive quarter. The company has increased its self mining operational hashrate from 1.40 EH/s to 2.8 EH/s during the quarter, an increase of 100%, and is further expected to increase this hashrate to 5.5 EH/s by adding an additional 50 MW of power, in the coming weeks, at its Lake Mariner site in New York state.

The company produced 233 Bitcoin in March at a daily rate of 7.5 Bitcoin per day, an average daily increase of 47.2% on the previous month. The company continues to sell its Bitcoin to cover capital and operational costs.

It should also be noted that TeraWulf has one of the cheapest energy costs publicly disclosed. During the month of March the company achieved a direct energy cost of approximately $0.032/kWh or $7,048 per Bitcoin, equating to an impressive gross margin of 72%.

Production Metrics

DMG Blockchain issued a statement in its March mining update to inform shareholders and the market that it is now reporting mined Bitcoin from Terra Pool on a full pay-per-share (FPPS) basis. The company has recalculated its February mining results, which now indicate 76.7 Bitcoin mined produced in the month rather than the 89.2 mined Bitcoin, as previously reported.

In March, Bit Digital had a great month, producing significantly more Bitcoin that its operating hashrate would expect, achieving a total of 95.5 Bitcoin per EH/s (realized rate for March - 90.9 Bitcoin per EH/s), with a 101% utilization rate, of the available hashrate.

It comes as no surprise that Bitfarms, Iris Energy and CleanSpark made up the top four in both mining per EH/s and hashrate utilization, as they have been the most consistent performers of the last 18 months.

Meanwhile, Hut 8 continues with its dispute against Validus Power Corporation, a third-party supplier of energy to the company’s mining facility in North Bay, Ontario. This has meant the company is only currently operating at its Alberta facilities. Riot Platforms (RIOT) continues to focus its efforts on the repairs to damaged cooling systems in Buildings F and G.