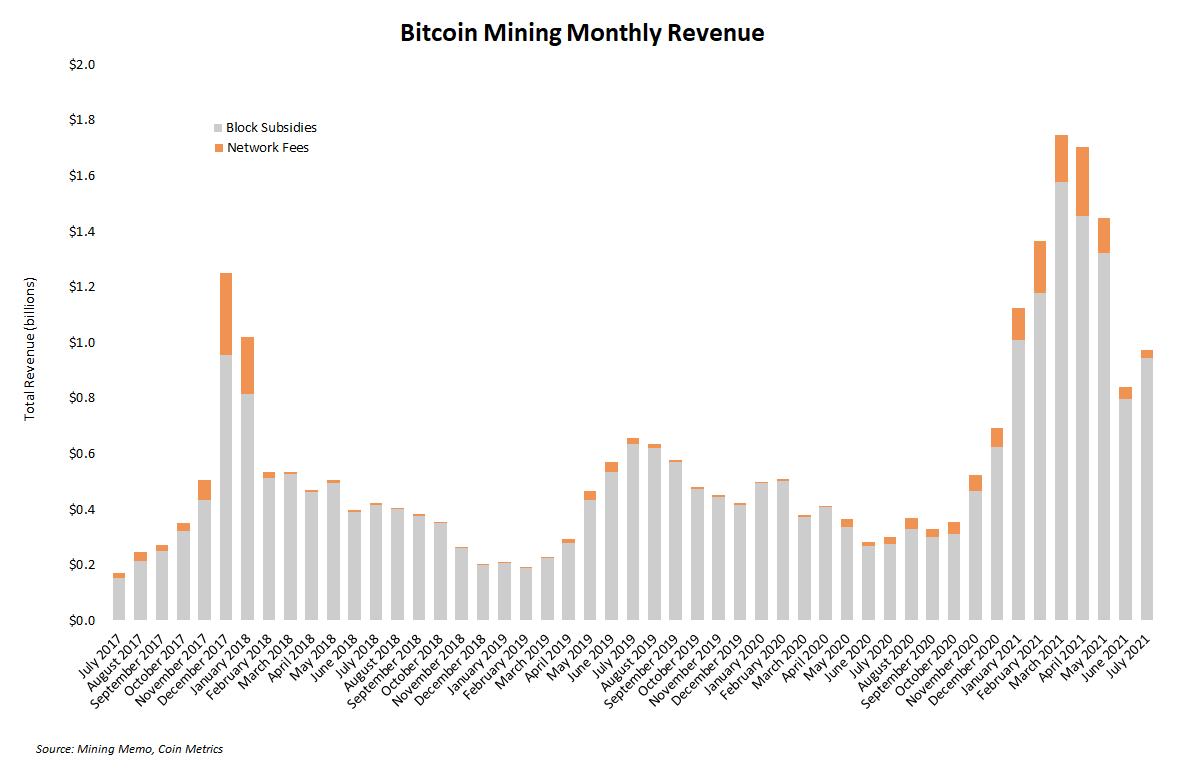

Bitcoin miners raked in a total of $971.8 million in July.

- Revenue jumped 16% from June, ending a three-month decline in mining revenue.

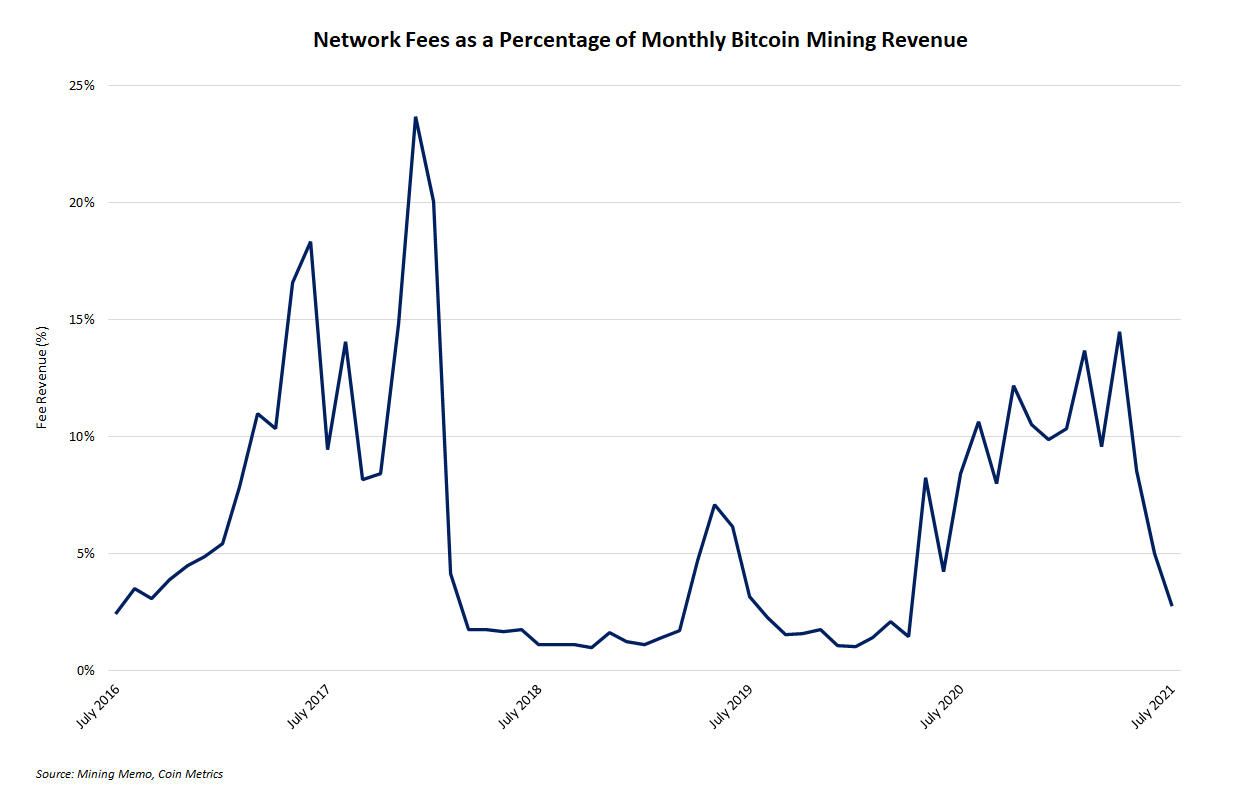

- Transaction fees only represented 2.84% of total revenue, the lowest mark since April 2020.

Want more mining insights like this?

As bitcoin continues to trade in the high $30,000s, monthly total miner revenue remains significantly lower as well. Although it eclipsed June, monthly miner revenue from July was the second lowest recorded in 2021.

Bitcoin’s depressed price isn’t the only reason for lower miner revenue. Bitcoin transactions are still significantly off their highs earlier this year near the market’s latest peak, according to data from Coin Metrics.

Fewer transactions means less fee revenue. Less than 3% of revenue in July came from transaction fees.

As the below chart shows, the strong upward trend of increasing fee revenue from May 2020 has broken and been almost fully retraced over the past five months. Increases in fee revenue are important to sustain the network’s security as the subsidy decreases every four years.

In the short term, a significant decrease in fee revenue is no cause for alarm. In the long term, fee revenue must play a significant role in financing miner activity. And even though aggregate revenue is down, profitability per miner is up significantly measured by hashprice.

A resurgence in monthly revenue and a revival in fee-based income depend on new life breathed into the bitcoin price. Until then, lower revenue and fewer fees (despite higher individual profitability) can be expected for miners.

$BTC pic.twitter.com/xrnatC4krF

— Mining Memo (@miningmemo) August 5, 2021