Bitcoin mining is for the streets, but the suits are here to play too.

Today leading investment bank Jeffries published a 24-page primer that gives a fairly comprehensive introduction to mining for institutional investors. Although the document’s material will be somewhat elementary to most experienced bitcoin miners, the breadth and depth of the primer sends a powerful message of traditional finance’s awareness of the mining industry.

Some of notable topics addressed in the report:

- Economics of mining

- Mining versus buying

- Public mining companies

- Bullish bitcoin predictions

- Mining market dynamics

Want more mining insights like this?

Key mining statistics from the primer

- All bitcoin mining infrastructure is valued between $15-20 billion.

- Bitcoin annualized mining revenue: $19 billion.

- Texas has the country’s cheapest commercial power costs at $0.02-0.03/kWh.

- Jeffries predicts North American public mining companies will control 15% of hashrate by the end of 2022.

The economics of mining

The Jeffries mining primer starts with correctly breaking down the economics of cryptocurrency mining. Power is by far the largest operating expense, the document correctly notes.

ASIC prices are often influenced by scale, the primer says.

“The large-scale miners, which order tens of thousands of miners at a time, will pay significantly less per machine than the hobby-miner who is only buying a few machines.”

Clearly Jeffries isn’t aware that Compass is making mining accessible to everyone at any scale. But that’s a discussion for another time.

The primer spent several paragraphs explaining the difference between total network hashrate, and individual miner’s hashrate, and the payouts a miner can expect based on their share of hashrate. This section yielded the mining formula below.

Buying bitcoin versus mining it

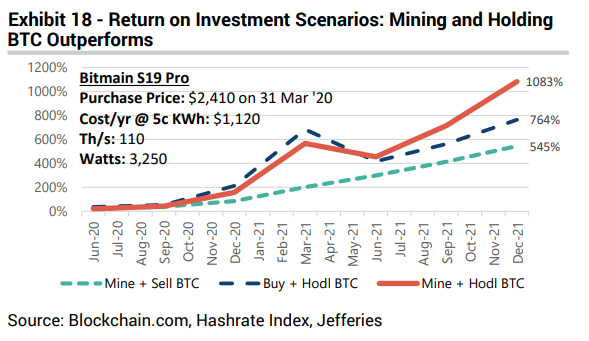

Jeffries' primer tackles the persistent question of whether mining is more profitable than simply buying bitcoin. Of course the analysis finds mining to be more profitable, which is the correct answer. In this analysis, they note:

- The cost to buy an ASIC miner is generally earned back within 6-12 months.

- Mining has resulted in up to 5-6x higher returns over multi-year periods compared to buying and holding.

Overviewing public mining companies

The mining primer is quite bullish on the future of public mining companies. Roughly 8% of Bitcoin’s hashrate is owned by these companies, according to Jeffries. They expect that number to reach 15% by the end of 2022.

Jeffries even included a chart of bitcoin holdings by public companies.

Most of the analysis on public mining companies focused on pure-play mining, leaving out a variety of other companies that are involved in the bitcoin mining industry.

Beyond mining: bullish price predictions

The primer deviated from mining a bit to offer some analysis on future bitcoin price levels. Jeffries offered multiple future scenarios where bitcoin would serve as a partial or fully matched gold’s market cap and the M3 money supply.

The report said:

“The most common comparison for BTC is gold. In fact, it is often referred to as "digital gold". [...] The comparisons to gold are not perfect, however.”

Moving to M3 scenarios, the report said:

“Another argument for the future value of BTC is for the coin to replace fiat currencies in the money supply. Currently, paying for just about anything with BTC is very difficult or impossible. However, in the next few years, we believe this could start to change.”

The dynamics of the mining market

Beyond basic analysis of the operational details of the mining industry, the primer noted how the market adjusts to bearish market conditions.

“If the price of BTC goes down, that will hurt profitability and lengthen payback periods. However, the mining market has two ways of self-correcting.”

The primer correctly notes that in persistent price downtrends:

- “Miners in areas with high power costs will unplug their machines, which increases the potential mining rewards for those that are still mining.”

- “The price to buy new ASIC miners will decline along with the BTC price, which reduces the cost of entry.”

Conclusion

Institutional investors reading Jeffries’ primer got a broad, accurate, and data-heavy introduction to cryptocurrency mining. The past 18 months of mining news have been dominated by institutional mining activity. Although retail and at-home mining interest is also surging, this primer signals strong interest by non-retail players and a likely continuation of the institutional mining trend.