Bitcoin’s price continues its downward trajectory, 72% down from the all-time high set during November 2021. The cryptocurrency now trades at about $19,200.

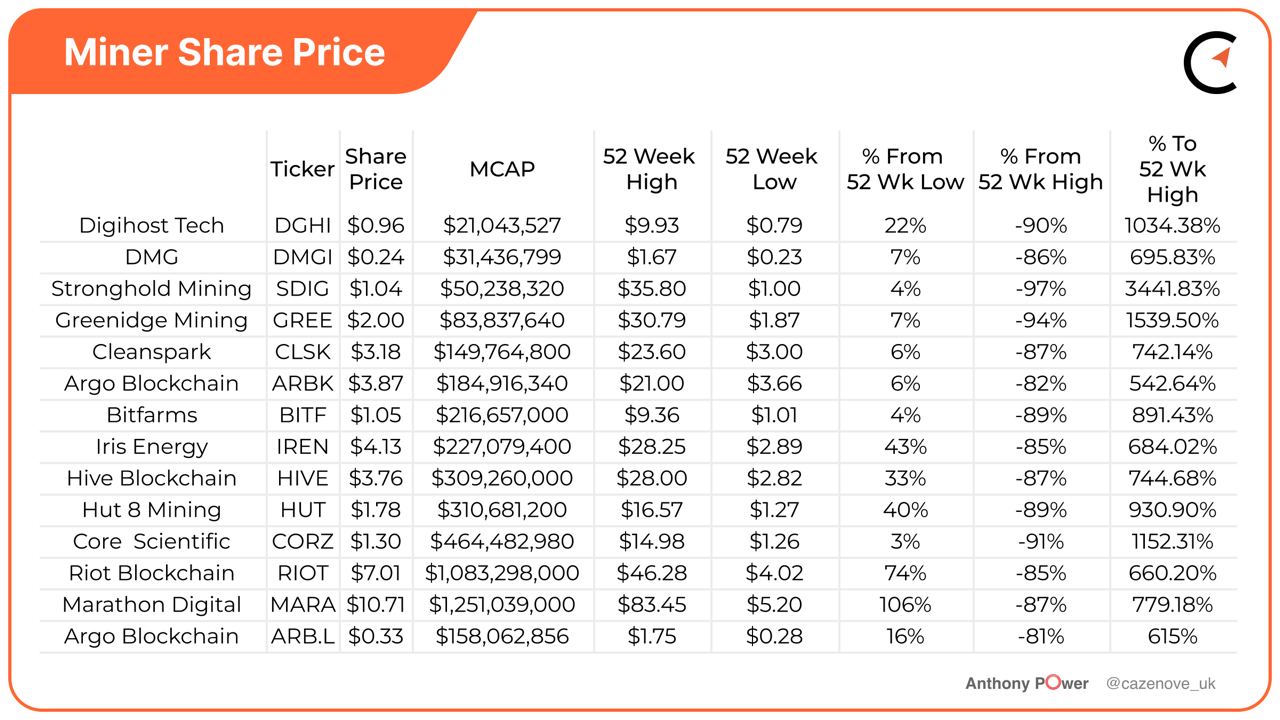

The values of the North American listed Bitcoin mining stocks have followed, dropping an average of 88% from their 52-week highs. Of course, there are many global and macroeconomic contributing factors that haven't helped asset prices in 2022, notably the war in Ukraine, the global rise in oil and gas prices, the pandemic and the threat of a recession. All these events have definitely changed the global economic outlook.

The drop in Bitcoin price–and increase in the cost of energy currently being paid by those miners, especially those who do not have a fixed price contract–has seen miners having to continually re-evaluate their future growth plans. For example, Argo Blockchain (ARBK) recently revised its end-of-2022 growth projection down from 5.5 EH/s to 4.1 EH/s, Bitfarms (BITF) reduced from 8.0 EH/s to 6.0 EH/s and HUT 8 (HUT) reduced its end-of-year target of 6.0 EH/s to a more achievable 3.5 EH/s (actually close to what it was forecasting to achieve by the end of December 2021).

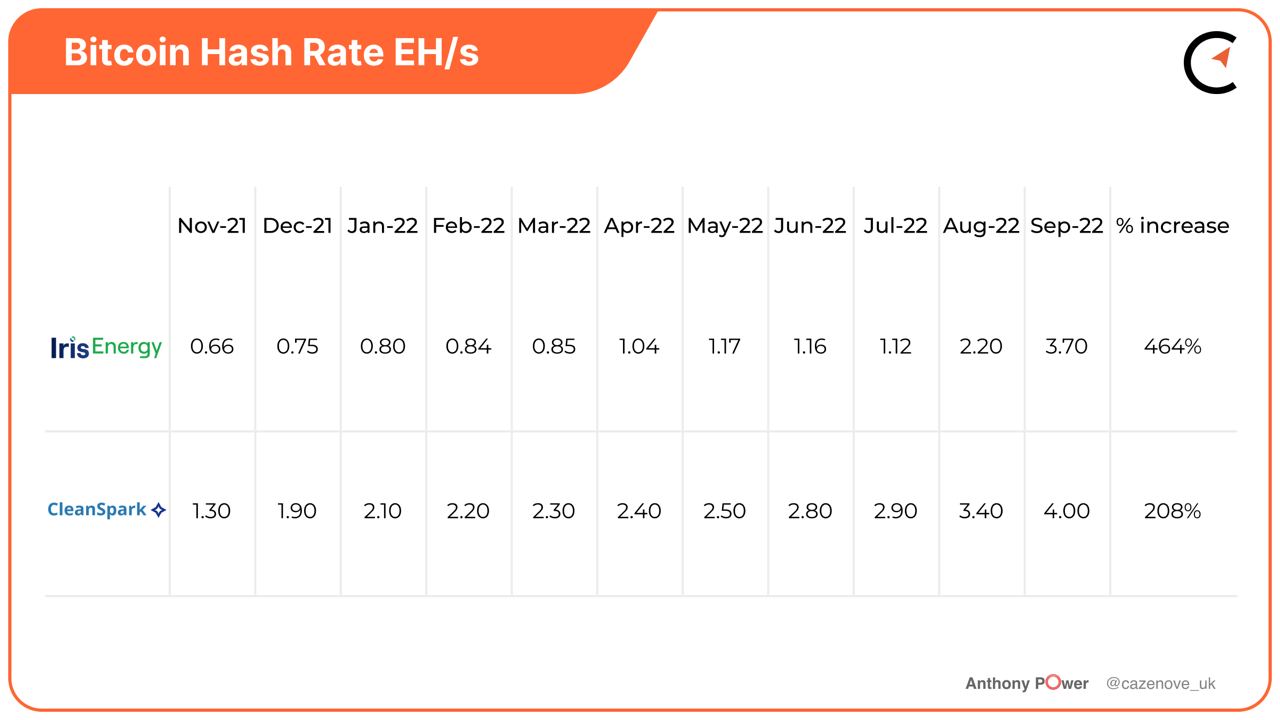

However, two miners appear to have bucked this trend over the last year: Cleanspark (CLSK) and Iris Energy (IREN).

Cleanspark (CLSK)

Less than a year ago in November 2021, Cleanspark had an operational hashrate of only 1.3 EH/s. Since, it has steadily increased its hashrate every month to a current 4.0 EH/s, equating to an increase of 208%. This total hashrate was assisted by the recent purchase of Mawson Infrastructure Group Inc.'s (MIGI) Bitcoin mining facility in Sandersville, Georgia, for a price of $33 million.

Watch: How CleanSpark Has Dominated The Bear Market

The facility should add 1.4 EH/s to Cleanspark’s total before the end of 2022, 2.4 EH/s by early 2023 and 7.0 EH/s by the end of 2023. The Las Vegas-based firm currently has an ambitious growth target of over 22 EH/s, by the end of 2023.

Included in the deal was a provision for 6,468 of the latest-generation mining ASICs for approximately $9.5 million in cash. At a cost of $17 per TH/s from Mawson, the rigs add 558 PH/s to the current hashrate as shown in the growth between August and September, as seen in the table below.

Iris Energy (IREN)

Iris Energy has appeared to have grown even more impressively over the same period: from 0.66 EH/s in November 2021 to a current 3.7 EH/s achieved during September 2022, or an increase of 464% over the last 11 months.

It should be noted that Iris Energy had to also re-evaluate from an original planned hashrate of 15.2 EH/s to a new target of 6.0 EH/s. This target includes an initial 40 megawatt (MW) development planned at the 600 MW Childress site in Texas. Of other importance is $83.3 million in remaining payments for contracted miners above the 6.0 EH/s of capacity, which remain subject to ongoing discussions with Bitmain.

Read: A tale of two miners: Bitfarms and Iris Energy

In March 2022, the company completed a loan facility with lending firm NYDIG for $71 million secured by 19,800 Bitmain S19j Pro miners over a period of 25 months. The deal was struck at an 11% rate, when the price of Bitcoin was over $47,000. Iris Energy now has the financial commitment to repay $3.2 million each month in capital and interest payments for this loan. That currently equates to 166 Bitcoin a month, a value greater than the company's Bitcoin production for the whole of July 2022 and just $198,000 less than the total revenue achieved during the month.

As many miners have done, Iris Energy turned to the finance markets for additional capital. On Sep. 23, Iris Energy signed a deal to sell up to $100 million in equity to investment bank B. Riley over the next two years. The bank agreed to an equity stake of approximately 30%, based on the closing price on Friday, Sep. 30. The company will use the proceeds from the deal to fund growth, hardware purchases, acquisitions, development of data center facilities and capital for general corporate purposes.

Operational Performance

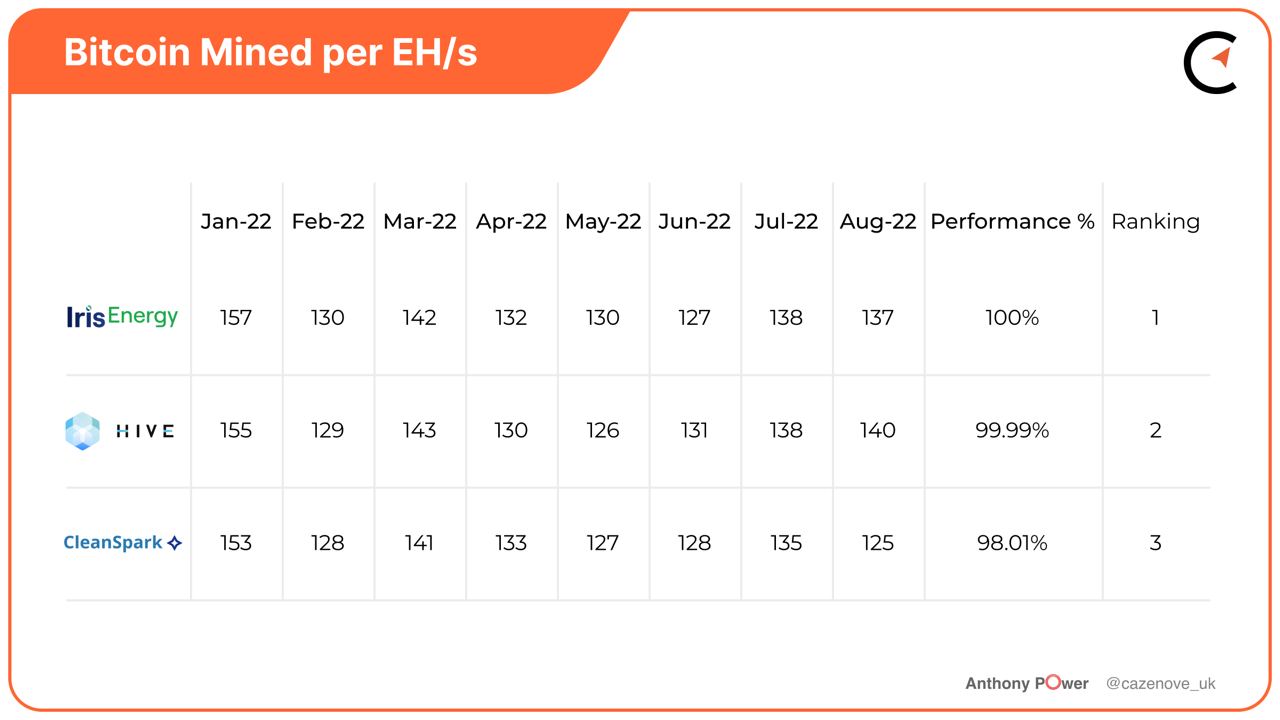

Bitfarms Chief Mining Officer Ben Gagnon put it best when he said earlier this year that markets should “judge miners on what they do each month, and not solely on the future hash rate growth strategies you see being published.”

While other miners have issued higher hashrate projections, both Cleanspark and Iris Energy have been consistently high performers in terms of producing Bitcoin per EH/s. The table below highlights Iris Energy as ranked number one of all the North American listed miners, and if we compare all miners to this performance, Cleanspark comes a credible third place achieving 98.01% of Bitcoin miners per EH/s in comparison.

Read: Understanding Bitcoin mining monthly production updates

Both Cleanspark and Iris Energy sell Bitcoin regularly, throughout the year, to provide cash flow for their capital growth and operational costs. Iris Energy actually sells its Bitcoin on a daily basis, as the company currently believes that by reinvesting today it will generate more Bitcoin tomorrow.

The contrast here looms large. A large number of North American listed Bitcoin miners have continually sold their “hodl.” For example, Core Scientific sold off the majority of its nearly 10,000 BTC treasury over the summer months, only to later tap into equity markets. Only Marathon Digital (MARA) and Hut 8 (HUT) have managed to maintain their Bitcoin hodl intact throughout this current bear market. Given the stellar performances of Cleanspark and Iris Energy, an argument for selling Bitcoin can confidently be made.