Viridi Funds launched RIGZ, a green cryptocurrency mining ETF, in late July to “align profit with purpose,” according to its press release. While no doubt amply supplied with purpose, the fund’s profit efforts weren't quite a home run during its first quarter of trading compared to returns achieved by simply holding bitcoin, not to mention the dozens of other cryptocurrency- and mining-related assets that outperformed bitcoin last quarter.

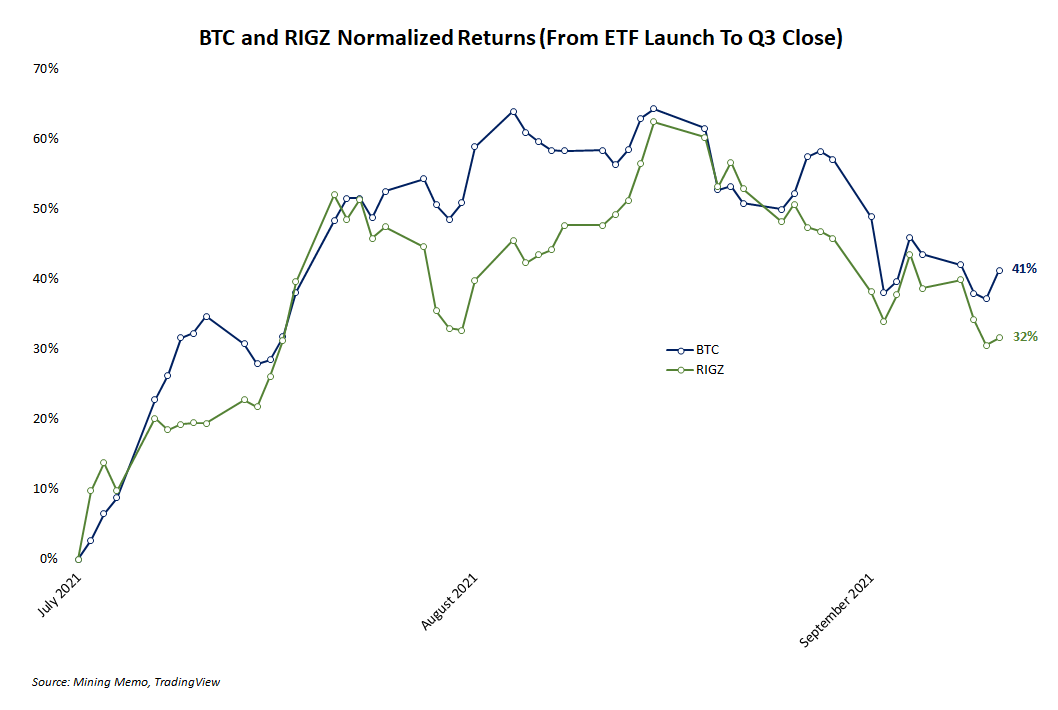

- RIGZ underperformed BTC by nearly 10 percentage points.

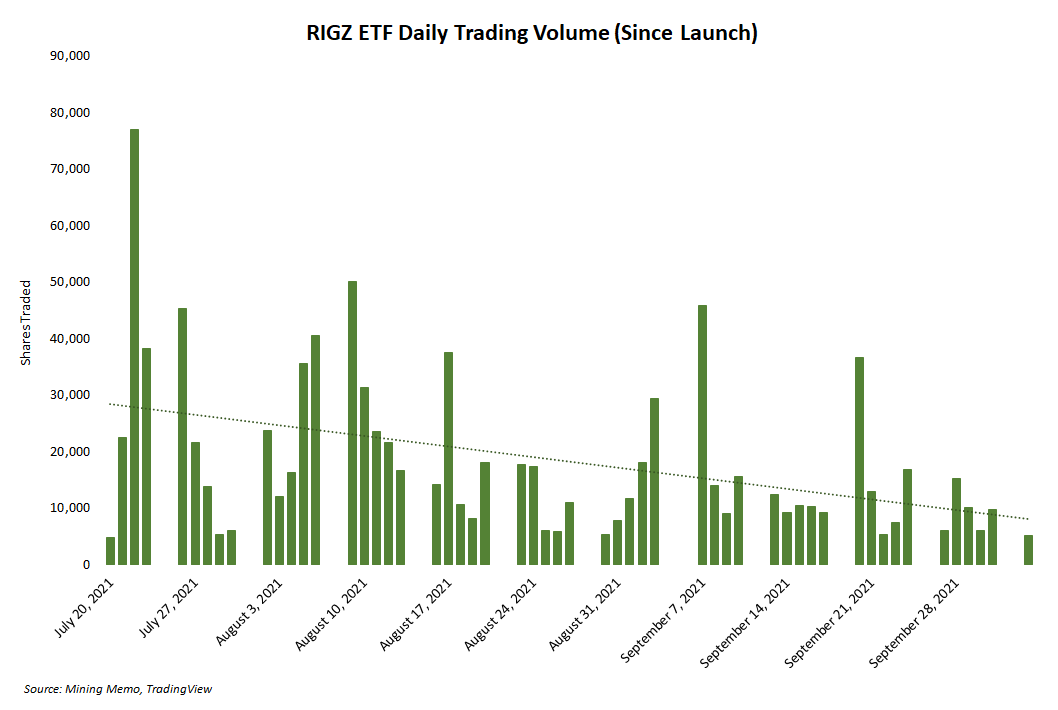

- Daily RIGZ trading volume steadily declined through Q3.

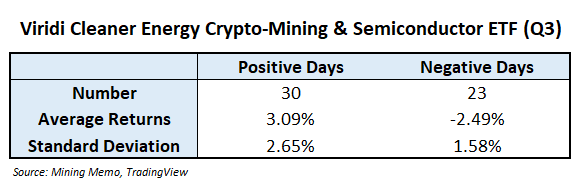

- RIGZ enjoyed only seven more positive days than negative ones in Q3.

Want more mining insights like this?

Here’s a quick breakdown of the RIGZ ETF daily performance from its launch in late July through the end of the third quarter

For most cryptocurrency investments, whether digital assets or traditional equity, the goal is to outperform bitcoin or ether. Unfortunately for RIGZ investors, this was not accomplished in Q3.

- From launch to end of Q3, RIGZ gained 32%.

- BTC gained 41% over the same period.

Trading volume is a classic indicator of the market’s appetite for a particular product. RIGZ volume steadily declined through Q3 as the linear trend line on the bar chart below indicates. Perhaps a green ETF will entice more traders in Q4 as rumors of bitcoin ETF approval are heating up again.

Given the newness of the product and its low trading volume, RIGZ can hardly be used as an accurate measure of investor appetite for “green” cryptocurrency mining. But if the language used by public mining companies is any indication, efficiency is an overwhelmingly more significant focus, not “being green.”

In any case, best of luck to RIGZ investors in Q4. Maybe their green fund will outperform the orange coin this time.