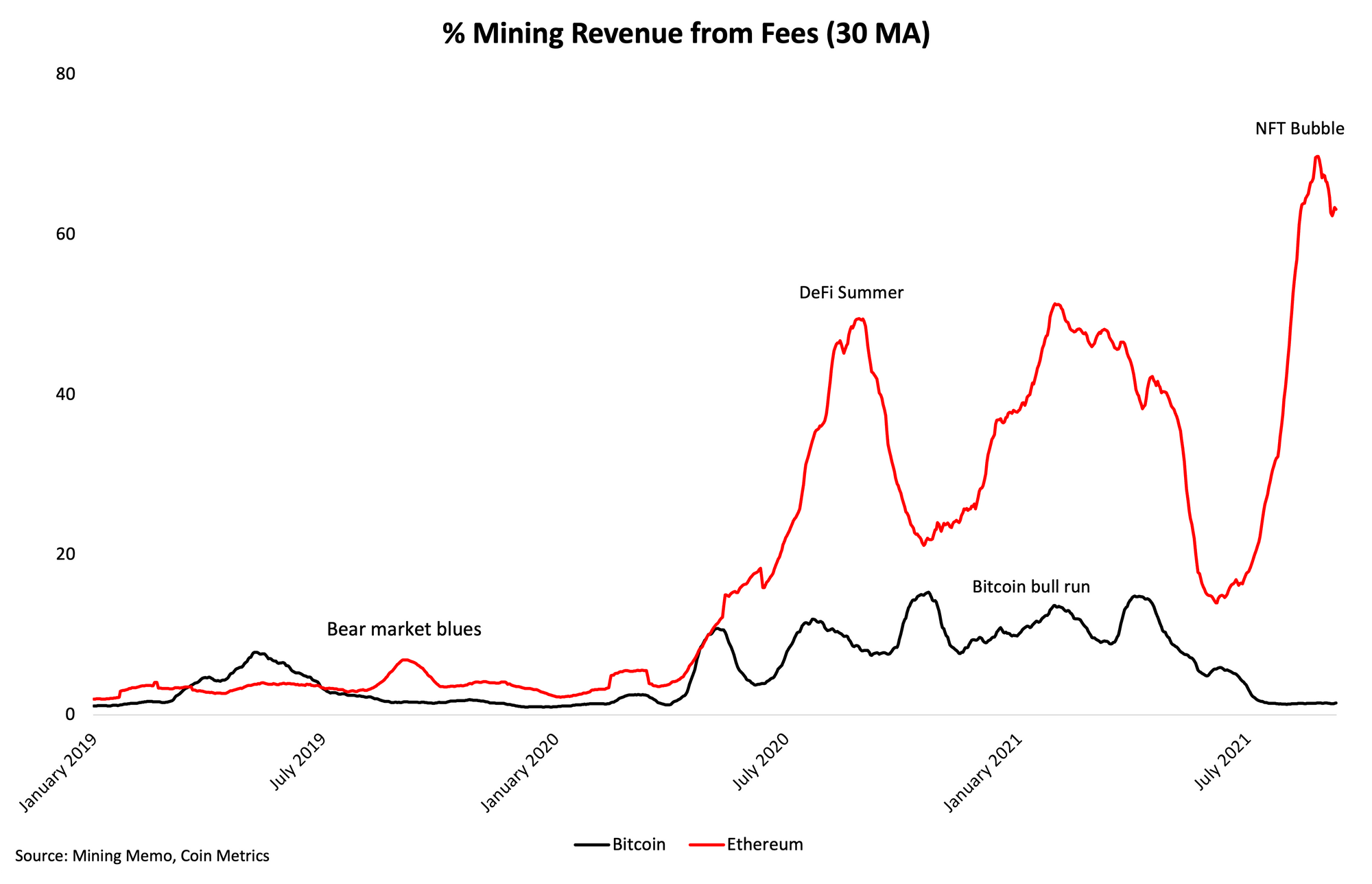

Most crypto-folk will remember September for price losses. But the data also shows how divergent the Bitcoin and Ethereum ecosystems are becoming based on design criteria.

- Last month, a record 66% of Ethereum mining revenue came from transaction fees.

- Bitcoin’s transaction fees constituted only a measly 1.4% of mining revenue.

Want more mining insights like this?

Initial on-chain data from October look no different, again showing the different paths to scalability the two largest proof-of-work chains have taken: supporting one asset or supporting many. Ethereum’s choice to support stablecoins and altcoins – substitute goods for Bitcoin – clearly hurts its monetization of on-chain transactions.

The conversation matters because Bitcoin mining will slowly transition away from coinbase rewards and to transaction fees only. If fees are low now, why not later?

Bitcoin's silver lining

Low Bitcoin fees aren't entirely bad. Cheap transactions do enable:

- Easier on-boarding of Bitcoin users.

- Less monetary incentive to reorg the blockchain.

Yet, low fees indicate low demand to settle on-chain using Bitcoin’s only asset, BTC, and could indicate a weak “security budget” going into the next halving.

Ethereum’s fee dominance also has its own issues – whose flipping tokens on Uniswap at $500 a pop? Although Ethereum’s security budget increases with further demand to trade on-chain, it pushes users to cheaper smart contract chains. The widespread adoption of Tether stablecoin on the Tron network is one such example.

For now, the takeaway remains that Ethereum-based assets act as a substitute for Bitcoin. Expect Bitcoin transaction fees to remain low in the short term if this phenomenon continues.