- The correlation between miners and Bitcoin has held steady.

- The average correlation of all miners is roughly 0.70, on a rolling basis.

Correlations between miners and Bitcoin have held steady since 2020. Before 2020, the 6-month rolling correlation was weak and oscillated from positive to negative. Correlation likely picked up in 2020 due to the anticipation of the halving and the start of a Bitcoin bull market.

Want more mining insights like this?

The chart below is the average, rolling 6-month correlation between miners (RIOT, HUT, BITF, MARA, HIVE, and BTBT) and Bitcoin.

What does correlation mean?

Correlation is a statistic that measures the degree to which two variables move in relation to each other. The computed value (correlation coefficient or R) results in a value between negative 1.0 and positive 1.0. A perfect +1.0 indicates that as one variable moves up or down the other variable also moves in the exact same direction, up or down. Inversely, a perfect -1.0 indicates that as one variable moves up or down, the other variable moves in the exact opposite direction to the same degree.

- Correlations are generally considered strong above a value of 0.7.

- Correlations are generally considered weak below a value of 0.5.

Do mining stocks move with Bitcoin?

The scope of this article is to measure the degree to which miners’ share price moves in relation to the Bitcoin price. Most investors of publicly traded miners are looking to outperform Bitcoin. Ergo, miners are considered a leveraged play on Bitcoin. So, investors would not want to see a negative correlation.

As expected, miners are showing a steady, positive correlation with Bitcoin. Here is a chart depicting the correlation by individual miners.

Current rolling 6-month correlation of Miners and Bitcoin:

- RIOT: 0.43

- HUT: 0.66

- BITF: 0.72

- MARA: 0.74

- HIVE: 0.79

- BTBT: 0.83

- Avg: 0.69

The above charts measure correlation on a rolling basis. Another way to measure correlation is by fixed periods. Here is a table showing it from as little as three months to three years.

Generally, correlation is stronger in shorter time frames, as investors/traders use miners as a proxy to speculate on Bitcoin.

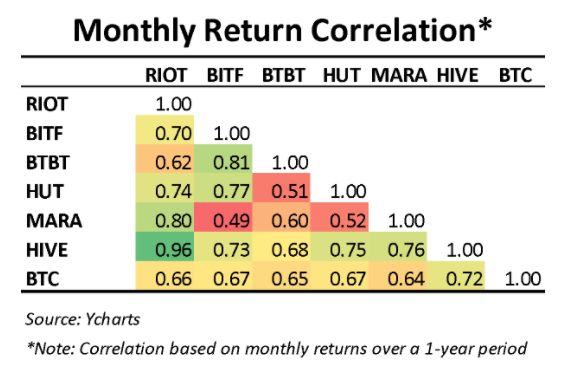

What about correlations between miners? How strong is the relationship between each miner? The final table shows the 1-year correlation below.

In summation, the correlations between miners and Bitcoin are positive; as Bitcoin appreciates or depreciates, miners should follow in the same direction.